AZ Tax Credit

Decide where your AZ taxes go!

HCS is a Qualifying Foster Care Charitable Organization (QFCO#10030).

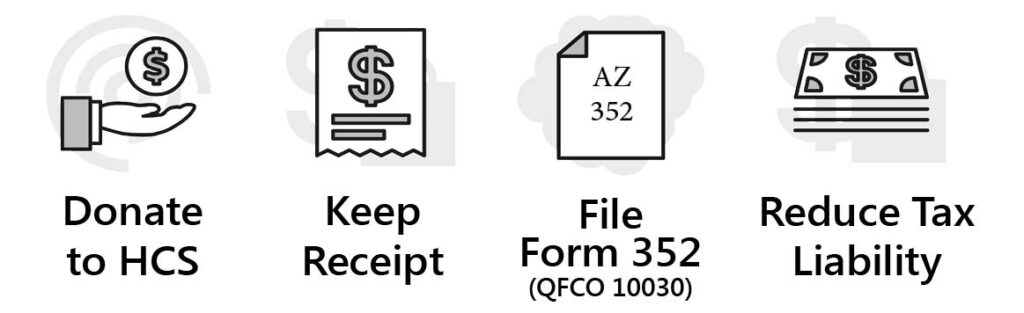

Here is how it works:

This means you can claim your donation on your AZ state taxes and get a dollar-for-dollar credit – reducing the amount you owe.

The maximum allowable tax credit for:

2023 is $526 for single or $1,051 for married filing jointly and 2024 is $587 for single or $1,173 for married filing jointly.

One Time Donation

Your donation creates a meaningful impact! Supporting our organization directly promotes healthy families with programs like trauma therapy and providing safe visits to strength families. When you invest in us, your donation can be matched dollar for dollar on your Arizona taxes. Let’s make a difference together!

Monthly Donor

By setting up a recurring donation, you’re making a powerful commitment to the future of youth in our community. With a recurring donation, you can support our youth and therapy animals consistently throughout the year and still claim your tax credit. It’s easy to set up, and you can choose a frequency that works best for you. Let’s create lasting solutions together!

Mail a Check

We also accept donations by mail or drop-off. Checks can be made out to Hope Community Services and mailed to:

Hope Community Services

5701 W Talavi

Suite 201

Glendale, AZ 85306

Click here for Tax Credit FAQ.

View our tax credit flyer.

Learn more about AZ Tax Credits on the AZ Department of Revenue website.

All donations to Hope Community Services are used to create lasting solutions for children and families!

© 2020 Hope Community Services. All Rights Reserved.